Quick Commerce Data Analysis 2025 for Trends and Performance

Quick Commerce Data Analysis 2025: Insights from Nana Direct, Carrefour & BinDawood

Introduction

The rapid evolution of e-commerce has significantly shifted consumer behavior in the grocery sector, giving rise to the quick commerce data analysis 2025 landscape. Quick commerce (Q-commerce) focuses on delivering products within a short window, often under one hour, making speed and efficiency critical. In Saudi Arabia, the adoption of Q-commerce has grown exponentially, driven by urbanization, smartphone penetration, and changing lifestyle preferences. This report presents a comprehensive overview of Scraped data for q-commerce market report 2025, focusing on three major players in the Saudi Arabian market: Nana Direct, Carrefour, and BinDawood. Additionally, it explores the role of real-time retail data scraping in understanding operational trends and customer behavior.

Market Overview

The Q-commerce market in Saudi Arabia has been witnessing robust growth, with consumers increasingly favoring rapid grocery deliveries. Platforms such as Nana Direct, Carrefour, and BinDawood have leveraged digital solutions, app-based ordering, and strategic partnerships to enhance their reach. Insights from Saudi Arabia grocery delivery trends data extractor indicate that urban areas such as Riyadh and Jeddah contribute the majority of orders, reflecting high consumer demand for convenience-oriented services.

Key Metrics by Platform

| Platform | Monthly Active Users (MAU) | Avg. Delivery Time | Popular Categories | Order Volume (Monthly) |

|---|---|---|---|---|

| Nana Direct | 1,200,000 | 35 mins | Fresh Produce, Beverages | 850,000 |

| Carrefour SA | 2,500,000 | 45 mins | Packaged Food, Household | 1,400,000 |

| BinDawood | 1,800,000 | 40 mins | Dairy, Snacks | 1,050,000 |

The table above showcases the operational performance metrics of these platforms. Nana Direct’s shorter delivery times and high order fulfillment rates position it as a leading Q-commerce operator. Carrefour SA, with the largest user base, demonstrates strong brand recognition and reach. BinDawood, meanwhile, maintains consistent service quality, particularly in dairy and packaged snack categories.

Nana Direct: Growth and Analytics

Nana Direct has emerged as a dominant player in the Saudi Q-commerce landscape due to its technologically driven approach. With a focus on rapid inventory turnover, seamless app experience, and efficient last-mile logistics, the company has gained significant traction among urban consumers. Extract Carrefour Saudi data analytics to reveal trends in pricing, stock availability, and delivery efficiency, providing strategic insights for competitors and investors.

- Customer Trends: The majority of orders consist of fresh produce and beverages, reflecting growing health-conscious behavior among consumers.

- Operational Insights: Nana Direct leverages automated inventory management systems, which are critical for maintaining short delivery times.

- Pricing Analysis: Competitive pricing strategies are maintained by monitoring competitors’ offers in real time using Nana Direct data scraping tools.

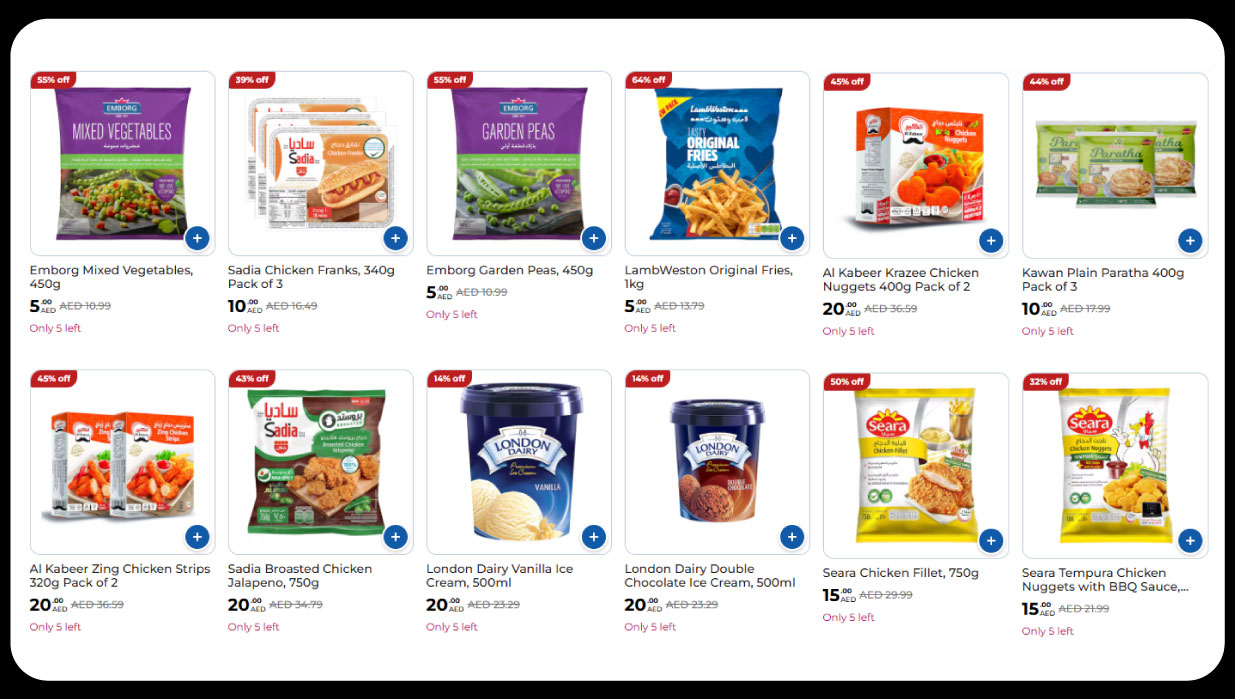

Carrefour Saudi: Market Penetration

Carrefour Saudi has traditionally been recognized for its physical stores but has strengthened its online presence to compete in Q-commerce. Analysis of BinDawood online retail data insights and Carrefour’s platform performance shows that diversified product offerings and frequent promotions drive higher engagement.

- Customer Preferences: Household items and packaged foods dominate orders on Carrefour’s platform.

- Data Insights: Saudi Q-commerce data extraction tools indicate that promotional campaigns significantly boost order volumes.

- Delivery Metrics: Despite slightly longer delivery times compared to Nana Direct, Carrefour maintains high satisfaction rates due to reliable packaging and stock availability.

| Product Category | Nana Direct (Orders/Month) | Carrefour SA (Orders/Month) | BinDawood (Orders/Month) |

|---|---|---|---|

| Fresh Produce | 300,000 | 450,000 | 280,000 |

| Packaged Foods | 200,000 | 500,000 | 300,000 |

| Beverages | 180,000 | 300,000 | 200,000 |

| Dairy & Snacks | 170,000 | 150,000 | 270,000 |

This table provides category-wise order data, highlighting consumer preferences and platform performance. The data confirms Nana Direct’s strong performance in fresh produce and beverages, Carrefour’s dominance in packaged foods, and BinDawood’s focus on dairy and snacks.

BinDawood: Operational Strengths

BinDawood has positioned itself as a reliable mid-sized player in the Saudi Q-commerce sector. Leveraging its established offline presence, it integrates online platforms for a hybrid retail approach. Scrape Nana Direct q-commerce data to reveal that BinDawood’s strengths lie in consistent stock availability and specialized product categories.

- Customer Insights: Customers show loyalty due to product variety and timely deliveries.

- Data-Driven Decisions: Insights gathered from quick commerce API data and analytics dashboards enable BinDawood to optimize delivery routes and inventory management.

- Market Intelligence: Scraping q-commerce market intelligence allows BinDawood to monitor competitor pricing and promotions in real time.

Methodologies and Tools

The data presented in this report was collected through a combination of Quick Commerce Data Scraping Services, real-time API integrations, and proprietary retail analytics tools. The methodologies included:

- Automated Web Scraping: Used to collect product prices, stock status, and promotional campaigns across platforms.

- API Data Extraction: Leverage q-commerce market intelligence for real-time order and delivery metrics, particularly from Nana Direct and Carrefour.

- Data Cleaning and Validation: Ensured accuracy by cross-verifying with multiple sources and historical data.

- Trend Analysis: Insights into seasonal demand, peak order times, and category performance were extracted using statistical modeling.

Strategic Insights

The Saudi Q-commerce market shows significant growth potential, with key insights including:

- Urban demand is concentrated in fresh groceries and beverages, emphasizing the need for optimized cold-chain logistics.

- Real-time monitoring using quick commerce API data Scraping and similar tools helps platforms stay competitive.

- Carrefour’s wide assortment and promotions indicate that brand recognition and loyalty remain crucial.

- BinDawood’s hybrid offline-online approach offers resilience against delivery bottlenecks and stockouts.

- Grocery Dataset from Carrefour Saudi Arabia provides detailed insights into product-level performance, aiding strategic pricing and inventory planning.

Conclusion

The 2025 Q-commerce landscape in Saudi Arabia highlights the critical role of data-driven decision-making. Leading platforms like Nana Direct, Carrefour, and BinDawood are increasingly adopting advanced analytics to streamline operations and improve customer satisfaction. Nana Direct Grocery Data Scraping enables real-time monitoring of inventory, pricing, and demand patterns, allowing the company to optimize delivery efficiency.

Similarly, BinDawood Grocery Data Extraction provides insights into product performance and order trends, helping the platform refine its service offerings. The availability of Grocery Dataset from Carrefour Saudi Arabia empowers market players to analyze consumer preferences and adjust strategies accordingly. Through evolving Quick Commerce Data Scraping Services, businesses can gather actionable insights, track competitor performance, and respond promptly to emerging trends, maintaining a competitive edge in the fast-growing Saudi Q-commerce sector.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

Source :

E-Mail : mailinfo@iwebdatascraping.com

Phone : +1 424 377758

Comments

Post a Comment